Democratic Sens. Chris Van Hollen from Maryland and John Fetterman from Pennsylvania are reintroducing a bill to aid the public transit sector, a funding reduction target under Trump's administration.

-

Property taxation is being targeted in a growing movement across the nation for cuts or elimination to address homeowner angst over rising tax bills.

December 16 -

Kathryn Garcia was tapped to lead the Port Authority of New York and New Jersey as it embarks on an ambitious capital plan.

8h ago -

Dallas and police and fire pension officials approved a funding agreement that ends litigation filed by the retirement system last year.

8h ago -

-

Inflation reports may drive markets in 2026 since the labor market is "sending mixed messages," said Kevin O'Neil, associate portfolio manager and senior research analyst at Brandywine Global.

6h ago

It is one of several P3-related recommendations the board made to Transportation Secretary Sean Duffy.

The Trump administration officially rolled out an Executive Order laying out federal policy on Artificial Intelligence which cements fears from states worried about the loss of broadband funding tied to the Bipartisan Infrastructure Law.

As more states weigh legislative action to decouple from the provisions of One Big Beautiful Bill Act, Treasury Secretary Scott Bessent launches an outreach mission to counter what he calls, a "blatant act of political obstructionism," that will lead to higher state taxes.

Photos from The Bond Buyer's 2025 California Public Finance conference.

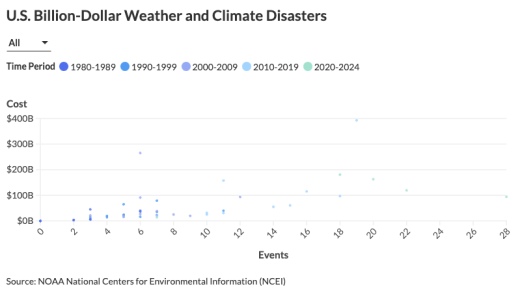

The steady demand for municipal bonds in high-risk areas underscores the complex relationship between climate change and financial markets.

Oppenheimer's Head of Public Finance Beth Coolidge and Columbus Auditor Megan Kilgore delve into the future of public finance and human infrastructure on a wide range of topics, from affordable housing and workforce development to public health, climate resiliency, and digital access.

As extreme weather events occur with more frequency across the country, Michael Gaughan, executive director of the Vermont Bond Bank, says municipal bond banks can help smaller communities deal with the effects of them. Gaughan speaks with The Bond Buyer's Lynne Funk on the effects of climate change and how the various levels of government can work together to address it.

A review Moody's launched in September ended with rating downgrades and negative outlooks for the city's outstanding general obligation and revenue bonds.

After terminating the project in September, the council approved an initial deal with a new contractor team to develop design and construction options.

The Texas city could revisit plans for a desalination project to boost its dwindling water supply with the city council scheduled to consider it next week.

-

The city council president hopes the panel will override the mayor's veto of the budget this week.

December 15 -

Federal Reserve Gov. Stephen Miran said higher goods prices could be the trade-off for bolstering national security and addressing geo-economic risks.

December 15 -

"The steps that would be necessary to restore a sound fiscal profile are becoming increasingly drastic," the rating agency said in downgrading Jersey City.

December 15 -

The New York City Transitional Finance Authority leads the new-issue calendar with $2 billion of future tax-secured subordinate refunding bonds.

December 12 -

Puerto Rico Gov. Jenniffer González Colón filed suit to end the island's contract with LUMA Energy for electrical transmission and distribution.

December 12